20/09/ · What does it Mean to Have a Long or Short Position in Forex? When going long, the trader will have a positive investment balance in a pair, hoping that the pair’s price will move up. On the other hand, going short involves a negative investment balance and the trader hopes that the pair will drop in price so that they can repurchase it later at a cheaper blogger.comted Reading Time: 3 mins A forex position is the amount of a currency which is owned by an individual or entity who then has exposure to the movements of the currency against other currencies. The position can be either short or long. A forex position has three characteristics: The underlying currency pair; The direction (long or short) The size; Traders can take A short position is basically something opposite to a long position. At the point when traders enter a short position, they anticipate the cost of the basic cash to devalue (go down). In short a currency intends to sell the basic currency with the expectation that its cost will go down, later on, allowing the trader to buy similar currency sometime in the future however at a lower blogger.comted Reading Time: 4 mins

Complete Overview on Long vs Short Positions in Forex Trading

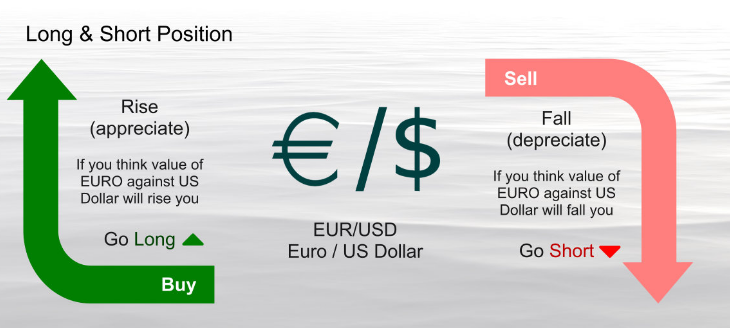

Understanding what it means to take a long or a short position in the Forex market represents essential knowledge and something that every trader should know. Simply put, traders go long when they believe the asset will increase in price or go short if they think the price will depreciate. A Forex position, which can be either long or short, represents the amount of long position vs short position forex asset which is held by a certain party who has exposure to the price movements of the currency against a basket of other currencies.

Each Forex position is defined by its underlying currency pair, its long or short direction and size. Investors can trade a number of different currencies in the market long position vs short position forex based on how they believe the currency will behave they take long or short positions.

The size of the position traders take depends on their account size and margin requirements. On the other hand, going short involves a negative investment balance and the trader hopes that the pair will drop in price so that they can repurchase it later at a cheaper price.

In this particular case, the trader is hoping that the EUR will rise against the greenback. Traders utilize various technical indicators to identify buy and sell signals and make their move. They search for buy signals to take a long position or sell signals to go short. Going short is the exact opposite of taking a long position.

Like you already know by now, traders take a short position if they believe the price of an asset is going to slip. Traders take a short position in a bid to buy it back later in future at a lower price, long position vs short position forex. Profit is reflected in the difference between the higher selling price and the lower purchase price. One of the common examples of a sell signal is when the price of the underlying asset touches the resistance level or brakes below support.

In conclusion, knowing about long and short positions in Forex and their basic characteristics represents the essential knowledge of Forex trading. Every Forex position is established by its underlying asset, the direction, which can be long or short and its size.

If You Want to Become a Successful Forex Trader, You Must Join AndyW Club. In AndyW Club you can get exclusive Forex trades, analysis and signals notifications via dedicated APP, E-Mail or Telegram, long position vs short position forex. Click Here and Join AndyW Club Now — You Can Cancel Anytime, No Questions Asked!

Search for: Search. What is a Position in Forex Trading? What does it Mean to Have a Long or Short Position in Forex? Going Short Going short is the exact opposite of taking a long position. Scroll to top.

Learn a Tool - Long \u0026 Short Position on TradingView

, time: 18:47Long vs Short Positions in Forex Trading - AndyW

A forex position is the amount of a currency which is owned by an individual or entity who then has exposure to the movements of the currency against other currencies. The position can be either short or long. A forex position has three characteristics: The underlying currency pair; The direction (long or short) The size; Traders can take A short position is basically something opposite to a long position. At the point when traders enter a short position, they anticipate the cost of the basic cash to devalue (go down). In short a currency intends to sell the basic currency with the expectation that its cost will go down, later on, allowing the trader to buy similar currency sometime in the future however at a lower blogger.comted Reading Time: 4 mins 20/09/ · What does it Mean to Have a Long or Short Position in Forex? When going long, the trader will have a positive investment balance in a pair, hoping that the pair’s price will move up. On the other hand, going short involves a negative investment balance and the trader hopes that the pair will drop in price so that they can repurchase it later at a cheaper blogger.comted Reading Time: 3 mins

No comments:

Post a Comment