In Malaysia they are known as “no dealing desk” brokers. When trading on an ECN or STP Forex broker in Malaysia, a trader is not trading against that operator. Therefore there is no conflict of interest between the trader and operator. ECN and STP Forex brokers usually offer low spreads, but will charge a commission for each trade 72 rows · Forex in Malaysia. Forex trading is legal in Malaysia, although The Bank Negara Malaysia 10/09/ · Best Forex Brokers Malaysia. To find the best forex brokers in Malaysia, we created a list of all internationally regulated forex brokers, then ranked brokers by their Overall ranking. Here is our list of the top forex brokers in Malaysia. IG - Best overall broker , most trusted ; Saxo Bank - Best for research, trusted global brandEstimated Reading Time: 4 mins

Forex trading in Malaysia and a list of best brokers in Malay in | Mr Forex MY

Forex Malaysia follows a strict editorial standard in our review process. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. ECN brokers are attractive because they offer direct market access, removing any conflict of interest with the trader, while oftentimes reducing trading costs by charging a volume-based trading commission on top of a tight spread fee.

These are the best ECN brokers in Malaysia foraccording to our testing and our research. To test these brokers, we opened a live trading account and deposited Ringgit. As a part of our test, we confirmed their status as ECN brokers by studying their client agreements and reviewing their trading costs to ensure they always have variable spreads with an additional commission.

We verified the absence of dealing desks, that we experienced both positive and negative slippage, and no trading restrictions were imposed. ECN brokers use high-speed networks to find the best pricing available and execute trade orders as quickly as possible. Where a ECN broker gets its market pricing and how fast it executes trades should always be considered alongside other more standard broker metrics.

When comparing ECN brokers, always consider:, list of forex brokers in malaysia offer ecn. Trading cost: Traders seek out ECNs brokers because of their low trading costs.

Trading costs on ECN accounts are a combination of the spread and a commission. Execution quality: A combined metric used to discuss execution speed, slippage and rejection rate, execution quality describes the connection between the broker and the market and will directly impact the level of control a trader has over their positions. A high-grade ECN broker will have fast execution speeds, which leads to less slippage in pricing between when the order is executed and when it is opened, and less list of forex brokers in malaysia offer ecn rejection due to unavailable counterparties.

Better execution quality will produce fewer unintentional losses. Execution venues: ECN brokers are never counterparty to client trades. Instead, it uses its network to place trades with third parties. These third parties are called execution venues. Tradable Assets: A good ECN broker will offer clients a larger number of FX Pairs and other CFD assets to trade.

Having a limited set of trading assets can negatively affect the traders, as they would miss out on trading opportunities. Regulation: Regulators monitor the activities of the broker and the trading desk. Unregulated ECN brokers are dangerous as there is no way of telling if they are ECN brokers without making a deposit and opening a trade.

Brokers regulated by the FCA UKASIC Australia or MAS Singapore have better reputations for enforcement and thus ensure their member ECN brokers strictly follow protocols designed to protect clients and their trades. Trading tools: Leading ECN brokers will offer traders a free Virtual Private Server VPS service, guaranteeing high-quality execution around the clock.

Other trading tools offered by the best ECN brokers include indicator packages to assist with automated trading and in-platform market analysis tools such as Trading Central or Autochartist. While FXTM is not exclusively an ECN broker, it does offer two ECN accounts with leverage up to on the MT4 and MT5 platforms. The Advantage Plus Account offers commission-free ECN trading with spreads starting at 1.

FXTM also has a large volume of training material, including videos and webinars to help new traders get started. An additional set of videos covering analysis topics and more detail on chart-reading techniques is available for experienced traders.

OctaFX offers ECN trading on an MT4 Account, MT5 Account and cTrader Account. All accounts are market execution and while trading costs are higher than other ECN brokers on the cTrader account, the MT4 and MT5 Accounts offer commission-free trading with spreads as low as 0.

Commission-free spreads this low are only usually achieved by large market makers like AvaTrade list of forex brokers in malaysia offer ecn CMC Markets. Leverage is on all three accounts and the minimum deposit is USD. All accounts are available as Islamic swap-free accounts and all clients are provided negative balance protection.

OctaFX offers a wide range of bonuses and promotions. OctaFX always runs contests for traders with live accounts, prizes include cars, list of forex brokers in malaysia offer ecn, laptops and smartphones, list of forex brokers in malaysia offer ecn. Be aware that all of these bonuses have terms and conditions that need to be met. A long-established Australian ECN broker, Pepperstone offers MT4, MT5 and cTrader support, ASIC regulation and two simple accounts with ECN execution.

Pepperstone also offers a package of Smart Trader Tools for MT4, a suite of 28 expert advisors and indicators to help improve trade execution and management.

In addition, all traders users get access to Autochartist — a powerful pattern list of forex brokers in malaysia offer ecn plugin that automatically identifies trading opportunities based on price trends.

Axi is an ASIC and FCA regulated ECN broker with MT4 support, a wide range of trading tools and simple account options. Spreads on the Pro List of forex brokers in malaysia offer ecn start at 0 pips with a 7 USD commission. The most valuable trading tool that Axi offers for the MT4 platform is the MT4 NexGen plugin.

MT4 NexGen offers a sentiment list of forex brokers in malaysia offer ecn, a correlation trader, a more intuitive terminal window, and an automated trade journal. In addition, traders at Axi have access to AutoChartist, a powerful automated technical analysis tool, and PsyQuation, an AI diagnostic that tracks your trading style and coaches you into more profitable trades.

VPS hosting is list of forex brokers in malaysia offer ecn available, along with all the trading algos you wish to install to your MT4. IronFX is a well-regulated global broker with a wide range of account types, a low-cost micro account and over 80 tradeable currency pairs. The No Commission account offers ECN execution but no commission, but spreads are unusually wide on this account, starting at 1.

ECN traders will be more interested in the Zero Spread and Absolute Zero accounts, both with spreads starting at 0 pips. IronFX is well suited to beginners who want an ECN account on the MT4 platform, and experienced traders looking for exotic pairs and market execution. HotForex is a well-regulated broker with STP execution on all six different accounts on the MT4 platform.

The minimum deposit on the Micro Account is low, at 5 USD and spreads start at 1. For those that prefer ECN trading on MT4, the HotForex Zero Spread Account offers spreads down to 0 pips for a USD minimum deposit. For beginners, list of forex brokers in malaysia offer ecn, HotForex offers unlimited demo versions of all its MT4 account types.

HotForex supports MT4 via every method, including the MT4 MultiTerminal, which allows traders to manage multiple MT4 accounts from a single platform. MT4 is also available via web, desktop, and Android and iOS apps.

Trading tools available include free Autochartist, VPS services and the HFCopy copy trading service. For MT4 traders who want fast STP execution, it is difficult to recommend another broker. While not a pure ECN broker, FP Markets does provide ECN pricing — it streams its pricing directly from its liquidity providers — delivering low spreads but with fast STP execution. Commission is also low at 6 USD per lot round turn and the minimum deposit is only USD. And with an Equinix server cluster, most trades are executed in list of forex brokers in malaysia offer ecn 40 milliseconds, faster than most ECN brokers.

This makes FP Markets an excellent broker for scalping and EA trading on the Metatrader platforms. Admirals Markets offer two ECN accounts on MT4 and MT5. T he Zero.

MT4 account has spreads from 0 pips with commission varying between 1. MT4 account is 5 USD round turn, which is at the lower end of what similar ECN brokers can offer. Admirals has an excellent education suite, starting with the free Zero to Hero program where beginners can learn to trade in 20 days. The accompanying webinars Admirals publishes are detailed and helpful, and the overall onboarding experience is welcoming, responsible and genuinely educational. With intermediate and advanced trading education for experienced traders and access to Trading Central delivering trading insights, quality learning material is front and centre for all clients, list of forex brokers in malaysia offer ecn.

IC Markets is rare amongst ECN brokers, as it provides a welcoming environment for beginner traders. IC Markets offers an archive of structured course material, detailed independent market analysis, and expert-led webinars.

IC Markets offers two Raw Spread Accounts and a Standard Account, all with variable spreads, on the MT4 platform. The Raw Spread Accounts charge a small commission of 3. The Standard Account charges no commission but spreads start at 1 pip. IC Markets pricing relies on 25 different liquidity providers ensuring deep liquidity and some of the lowest spreads in the industry.

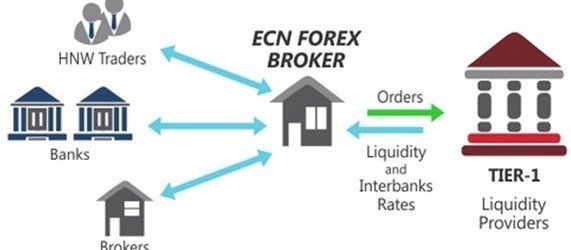

An ECN broker connects traders to a network of liquidity providers, unlike a Market Maker broker which takes trades on to its own books. ECN stands for Electronic Communication Network.

An ECN broker sits at the centre of this communication network, like a spider in a web, list of forex brokers in malaysia offer ecn. The other members of the network are liquidity providers like banks, hedge funds and other brokers. Every time a client places a trade with an ECN broker it collects prices from the members of this network and presents the trader with the tightest spread it could find to fulfill the volume requirement.

Because the liquidity providers in this network are competing for your trade, ECN brokers have very tight spreads which can approach 0 pips. ECN brokers do not make any money from the spread. Instead, they will charge a commission, which is their fee for playing matchmaker and finding a counter-party to your trade. Traditional brokers Market Makers have wider spreads because they charge their fee in the spread.

Because ECN brokers only act as an intermediary for a trade, they do not make money when traders lose. In fact, the reverse is true. Over time, a successful trader pays more in commission to an ECN broker, so ECN brokers want their clients to be profitable.

Traders may prefer to trade with ECN brokers because there is no conflict of interest between trader and broker. Most market maker brokers will trade against their clients in their role as the counter-party, which means the broker makes money when their clients lose.

Since ECN brokers earn money from client trade volume on all instruments traded, ECN brokers make more money when traders profit. ECN Brokers have a higher risk of slippage and requotes. This can be a problem at times of high volatility — usually after a large event or data release — or at times of low liquidity — such as when most of the markets are closed.

This also means that the market can move past your stop-loss orders, and your losses may exceed your expectations. The last thing to be aware of with ECN brokers is that they generally require a larger minimum deposit — setting up and maintaining an ECN brokerage is an expensive business and traders will be charged more as a result. ECN Brokers require higher minimum deposits.

Axi is the best ECN broker. With competitive pricing on raw spreads, high liquidity, and fast execution Axi won our Award for Best ECN Broker of Other highlights include a detailed and well-structured course for beginners and leading market analysis for all clients.

5 Best True ECN Forex Brokers 2021

, time: 3:5019 Best Forex Brokers Malaysia for - blogger.com

In Malaysia they are known as “no dealing desk” brokers. When trading on an ECN or STP Forex broker in Malaysia, a trader is not trading against that operator. Therefore there is no conflict of interest between the trader and operator. ECN and STP Forex brokers usually offer low spreads, but will charge a commission for each trade 15/06/ · Best ECN Brokers FXTM – Best ECN Broker in Malaysia. While FXTM is not exclusively an ECN broker, it does offer two ECN accounts with OctaFX – ECN Broker with the Best Bonus. OctaFX offers ECN trading on an MT4 Account, MT5 Account and cTrader Account. Pepperstone – ECN Broker with the Tightest Estimated Reading Time: 8 mins 72 rows · Forex in Malaysia. Forex trading is legal in Malaysia, although The Bank Negara Malaysia

No comments:

Post a Comment