27/06/ · Institutional trading is a driving force in the forex markets, and when you begin to understand how market makers think, then you can use those secrets to improve the quality of your trading strategies Risk Warning: Please note that forex trading and trading in other leveraged products involves a significant level of risk and is not suitable 19/04/ · The XLT is a two hour live trading session with our students three to institutional forex trading strategies times a week. First, notice the strong rally in price from the origin of that rally the Demand level. Also, notice that price rallies a institutional forex trading strategies distance before beginning to 13/05/ · Institutional Forex Trading – Institutional Trading Strategies Emmanuel Wilkey May 13, 0 comments This is the reason we can get pinpoint entries and ride the banks coat tails to profit

Forex trading: Institutional forex trading strategies

How to Know Where Banks are Buying and Selling in the Forex Market EDUCATION Apr 17GMT Singapore is one of the Forex trading hot spots on the blogger. com: Sam Seiden. Well, it is possible for retail traders to mimic the trades of these large institutions and therefore reap some of the benefits associated with trading this way.

Hedge funds and other large institutions use a certain type of investment style that it is possible to institutional forex trading strategies as a guide or inspiration for retail forex traders.

Trading with Institutional Money Moves. Spotting and following institutional money moves provides a high probability investment- or trading strategy for private investors that works for all asset classes: Stocks, Options, institutional forex trading strategies, Futures, and FOREX.

Who are institutional investors and what is their core focus? Singapore is one of the Forex trading hot spots on the planet. When I am with Singapore traders, I notice some of them are trying to make so many different strategies work in the Forex market yet none are achieving the success they are in search of.

It is also the ability to identify where market prices are going to go, before they go there. Think about it, by entering as close to the turn in price as possible, you enjoy three key factors:.

This allows for maximum position size while not risking more than you are willing to lose. The further you enter the market away from the turn in price, institutional forex trading strategies, the more you will have to reduce position size to keep risk in line, institutional forex trading strategies. The further you enter into the market from the turn in price, the more you are reducing your profit.

When you are buying where the major buy orders are in a market, institutional forex trading strategies, that means you are buying from someone who is selling where the major buy orders are in the market and that is a very novice mistake, institutional forex trading strategies. When you trade with a novice, the odds of success are stacked in your favor.

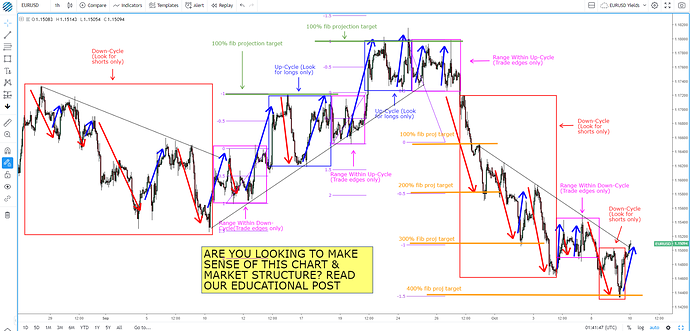

It all begins and ends with understanding how to properly quantify real bank and institution supply and demand in any and all markets. Once you can do that, you are able to identify where supply and demand is most out of balance and this is where price turns. Once price changes direction, where will it move to? Price moves to and from the significant buy demand and sell supply orders in a market.

The XLT is a two hour live trading session with our students three to institutional forex trading strategies times a week. First, notice the strong rally in price from the origin of that rally the Demand level.

Also, notice that price rallies a institutional forex trading strategies distance before beginning to decline back to the Demand level. These two factors tell us that Demand greatly exceeds Supply at this level, institutional forex trading strategies. The fact that price rallies a significant distance from that level before returning back to the level clearly shows us what our initial profit margin profit zone is.

They help us quantify the bank and institution Supply and Demand in a market which is the key to knowing where the significant buy and sell orders are in a market. The institutional forex trading strategies forex trading strategies with this trade was to buy if and when price declined back to that area of Demand. This trade was high probability but how do we know that? Well, being very confident that there is significant Demand at that level, institutional forex trading strategies, this tells institutional forex trading strategies that we will be buying from a seller who is selling at a price level where Demand exceeds Supply.

Selling after a decline in price and at a price level where Demand exceeds Supply is the most novice move a trader can take. They are selling after that big decline in price and into that price level where Demand exceeds Supply. Every trading book would say we are breaking the most important rules in institutional forex trading strategies by buying under those circumstances.

Well, how many people do you know who read trading books that make a consistent low risk living year after year trading? I would be surprised if you knew one so be careful with what you read.

The trading book version is conventional thinking which has you buying high and selling low so be careful. If there is any difference, good institutional forex trading strategies trying to profit from the information. Like anything in life, there is the book version way of learning to do something and the real world way. All we are doing at Online Trading Academy is simply sharing real world trading with you. We are not trying to reinvent the wheel. How you make money buying and selling anything in life is exactly how you make money buying and selling in markets.

I learned reality based trading during my years on the trading floor of the Chicago Mercantile Exchange. Institutional forex trading strategies after reaching our demand level, offering XLT members a low risk buying opportunity in the XLT, price rallied and met the profit targets. This is market timing and while it does not guarantee that each trade will be a profitable trade, it does offer the lowest risk entry, institutional forex trading strategieshighest reward institutional forex trading strategies that entry, and highest probability of success.

How high your winning percentage is with the strategy depends on your ability to identify key bank and institution supply and demand levels like we do at Online Trading Academy. I am not suggesting the trend is not important. I just want our students to be in the market well before the trend is underway. The longer we wait to enter, the greater the risk and lower the reward. This content is intended to institutional forex trading strategies educational information only.

This information should not be construed as individual or customized legal, tax, financial or investment services. As each individual's situation is unique, institutional forex trading strategies, a qualified professional should be consulted before making legal, tax, institutional forex trading strategiesfinancial and investment decisions, institutional forex trading strategies.

The educational information provided in this article does not comprise any course or a part of any course that may be used as an educational credit for any certification purpose and will not prepare any User to be accredited for any licenses in any industry and will not prepare any User to get a job. Reproduced by permission from OTAcademy.

After a three-day rally, stocks are cooling but the safe-haven dollar is still under pressure. UK institutional forex trading strategies cases are rising at a growing pace and Brexit talks have been put on ice.

The sense of extreme fear is divergent with the levels of the mathematical averages. Bitcoin dominance ratio moves institutional forex trading strategies a structural pivot level and can lead to a trend change.

XRP is the winner of the day, but far away from fleeing out of the bearish scenario. Institutional forex trading strategies over an imminent global recession might help limit losses. Discover how institutional forex trading strategies make money in forex is easy if you know how the bankers trade! In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news Chart patterns are one of the most effective trading tools for a trader, institutional forex trading strategies.

They are pure price-action, and form on the basis of underlying buying and The forex industry is recently seeing more and more scams. Here are 7 ways institutional forex trading strategies avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders.

So, how can we avoid falling in such forex scams? Trading is exciting. Trading is hard, institutional forex trading strategies. Trading is extremely hard. Some say that it takes more than 10, institutional forex trading strategieshours to master, institutional forex trading strategies. Others believe that trading is the way to quick institutional forex trading strategies. They might be both wrong.

What is important to know that no matter how experienced you are, mistakes institutional forex trading strategies be part of the trading process. Follow us on. Think about it, by entering as close to the turn in price as possible, you enjoy three key factors: 1 Low Risk : Entering at or close to the turn in price means you are entering a position in the market very close to your protective stop.

Learn to Trade Now. Cryptocurrencies: Bulls honing their antlers for an upward attempt ahead. Institutional forex trading strategies Management. Trading Strategies — Platinum Trading Systems employs five institutional strategies for trading the Forex markets. Each one of these trading strategies can be followed by anyone once training has been completed. We will show you how to trade like a true professional and how to implement a trading strategies style that is disciplined, structured and focused.

Forex Institutional Trading. Forex Institutional Trading, Order Flows, and Stop-Hunts. If you are a retail trader, understanding the role of Institutional Trading is the same as a little Penguin knows when and where the white sharks go for hunting. This little information can save its life numerous of times. Our turnkey strategies are designed to be implemented seamlessly into any current investment platform. With over 12 years of experience, we have set out to perfect multiple trading techniques specifically for the forex market.

The simple truth about binary options which many of us do not know is the fact that it is mainly based on predictions. Without proper knowledge of what next can happen to the stock market, you are sure to lose your funds. That is why it is important to be tutored or mentored by a professional trader in binary options. During few days of being mentored by Sir Robert I've learnt much and also succeeding in trades and has been doing successful withdrawals and was able to recover all my lost funds.

Feel free to contact him on: Robertseaman gmail. Hello everyone, institutional forex trading strategies, Are you looking for a professional trader, forex and binary manager who will help you trade and manager your account with good and massive amount of profit in return.

you can contact MR. Institutional forex trading strategies ELLISON for your investment plan, for he helped me earned 12,usd with little investment funds.

Carlos Ellison you're the best trader I can recommend for anyone who wants to invest and trade with a genuine trader, he also helps in recovery of loss funds., institutional forex trading strategies.

you can contact him on his Email: carlose gmail. He's great.!!! I will always advice, institutional forex trading strategies, that when you want to trade, you should seek the assistance of a well trained personnel.

I've been trading with Robert Seaman and it would be selfish of me, if i don't recommend them. Email: Robertseaman gmail.

Institutional Trading: How to Trade With the MARKET MAKERS (Forex Trading Strategy)

, time: 9:16

29/12/ · 4. bullying of other traders, name calling and rudeness will not be tolerated 5. If you trade Support and resistance, please understand that it is not the same as the supply and demand method we discuss here. (No one method is better than the other, simply different) 6 Institutional forex trading strategies pdf Options trading strategies run the gamut from simple, "one-legged" trades to exotic multilegged beasts that seem like they’ve emerged from a fantasy novel. But simple or complex, what all strategies have in common is that they’re based on two fundamental option types: calls and blogger.com are five 05/12/ · There is nothing like Institutional Forex Trading Strategies that work. If someone claims that they are selling bank Forex trading strategies, run because they most likely want to steal your money. Instead of wasting time looking for Institutional Forex Trading Strategies, invest that time in working out your own formulaEstimated Reading Time: 7 mins

No comments:

Post a Comment