26/05/ · Select the required indicators in the list of indicators and click on “Properties” or use the menu of indicators in the graph. Use the menu to manage the indicators: Indicator Properties Properties – opens the properties of the indicators; Combining Indicators. Moving Average + Stochastic. Bollinger Bands + Stochastic. MACD + RSI. Parabolic SAR + EMA. Fibonacci + MACD. Be Careful! How do you use forex indicators? Discover the Best Forex Indicators for a Simple Strategy 23/05/ · Then you can drop a second RSI in the same window as the first, that is to say drag and drop on top of the first RSI, then both will display in the same window. You can adjust them independently. You can stack indicators this way, no merging of the programs themselves is necessary

How To Combine The Best Indicators And Avoid Wrong Signals -

In keeping with the idea that simple is best, there are four easy indicators you should become familiar how to combine forex indicators using one or two at a time to identify trading entry and exit points: Moving Average. RSI Relative Strength Index Slow Stochastic.

The four types are trend like MACDmomentum like RSIvolatility, and volume. Out of the entire technical analysis toolkit, how to combine forex indicators, these are the top 4 indicators are our favorites for trend trading. As we have discussed, there are three primary trading signals that can be generated with the Momentum Indicator. These signals include the Line Cross, the Momentum Crossover, and the Divergence signal.

The best Momentum indicator signal is the Divergence signal. ADX values help traders identify the strongest and most profitable trends to trade. The values are also important for distinguishing between trending and non-trending conditions. Many traders will use ADX readings above 25 to suggest that the trend is strong enough how to combine forex indicators trend-trading strategies.

There are multiple moving average lines on a typical forex graph. Some of the most commonly used forex indicators for scalping are the simple moving average SMA and the exponential moving average EMA.

These can be used to represent short-term variance in price trends of a currency. What are Forex technical indicators? Based on different mathematical calculations, forex technical indicators are statistics of past market data. Traders use them extensively in their technical analysis to predict currency trends. They reflect the direction and the strength of a current trend.

How do you identify trends? The best way to identify trends, in my experience, how to combine forex indicators, is to use simple price action. Higher highs and higher lows signal an uptrend, while lower highs and lower lows represent a downtrend.

In order to forecast future movements in exchange rates using past market data, traders need to look for patterns and signals. Previous price movements cause patterns to emerge, which technical analysts try to identify and, if correct, should signal where the exchange rate is headed next. Candlestick charts show the open, close, high, and low prices during the trading time. Candlestick charts can be used to make decisions based on the trends, these charts are best used for short-term analysis.

Renko chart is an example of a candlestick chart. You can discount all indicators designed to predict a market move.

They are not, by themselves, a predictive trading system. Technical indicators are only useful as part of a complete reactive trading system. Skip to content Trading Currencies About Forex. Trading 0. The most popular way to invest in currencies is by trading currencies in the. Your foreign exchange business is easier with FNB-FXOnline. This foreign currency trading and payment. that of another, how to combine forex indicators. Forex is commonly traded in specific amounts called lots, or how to combine forex indicators the number of.

How do you do fundamental analysis? How to do fundamental analysis on stocks? How do you apply Fibonacci retracement? In order to find these Fibonacci retracement levels. Trading Currencies About Forex.

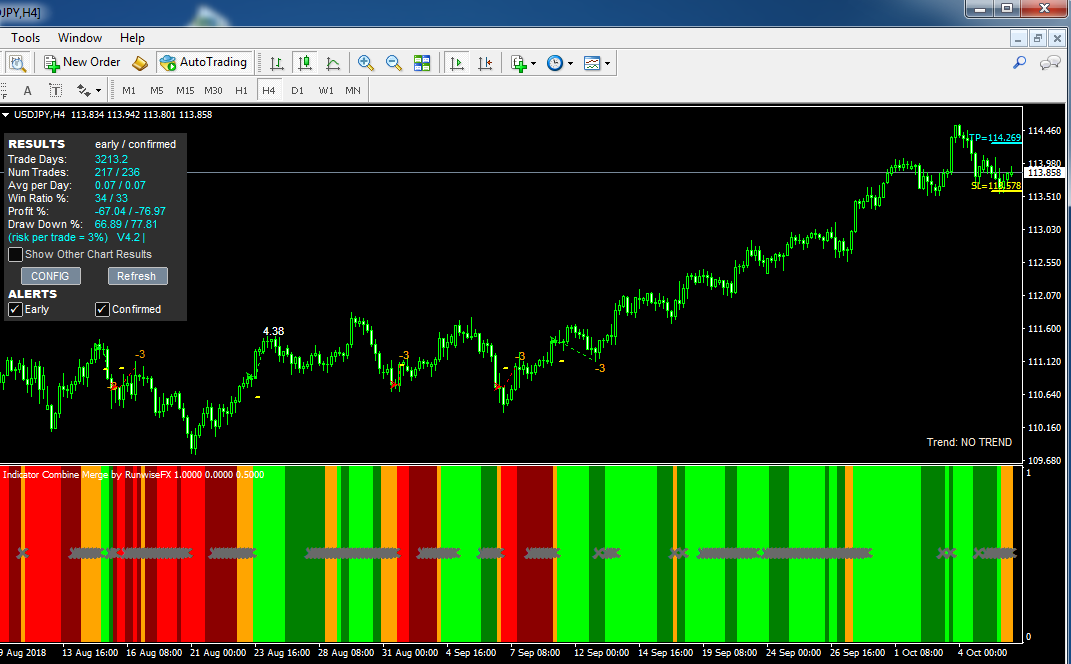

How to Combine Best Indicators MT4 for Profitable Trading?

, time: 7:313 Ways to Combine Forex Indicators

Combining Indicators. Moving Average + Stochastic. Bollinger Bands + Stochastic. MACD + RSI. Parabolic SAR + EMA. Fibonacci + MACD. Be Careful! How do you use forex indicators? Discover the Best Forex Indicators for a Simple Strategy 23/05/ · Then you can drop a second RSI in the same window as the first, that is to say drag and drop on top of the first RSI, then both will display in the same window. You can adjust them independently. You can stack indicators this way, no merging of the programs themselves is necessary 26/05/ · Select the required indicators in the list of indicators and click on “Properties” or use the menu of indicators in the graph. Use the menu to manage the indicators: Indicator Properties Properties – opens the properties of the indicators;

No comments:

Post a Comment