23/06/ · The trader could hedge risk by purchasing a put option contract with a strike price somewhere below the current exchange rate, like , and an expiration date sometime after the economic 10/12/ · A hedging strategy will have a direct cost. But it can also have an indirect cost in that the hedge itself can restrict your profits. The second rule above is also important. The only sure hedge is not to be in the market in the first place. Always worth thinking on beforehand The cost of the hedge is the cost of the put option. Not all retail forex brokers allow for hedging within their platforms. Be sure to research the broker you use before beginning to trade

Forex Hedging Strategies: How to hedge you trades

Ultimately to achieve the above goal it becomes necessary to pay someone else to cover downside risk. This article looks at several popular hedging strategies. The first section is an introduction to the concept of hedging.

The second two sections look at hedging strategies to protect against downside risk. Pair hedging is a strategy which trades correlated instruments in different directions. This is done to even out the return profile, hedging cost forex. Option hedging limits downside risk by the use of call or put options. This is as near to a perfect hedge as you can get, but it comes at a price as is explained.

Hedging is a way of protecting an investment against losses. It can also be used to protect against fluctuations in currency exchange rates when an asset is hedging cost forex in a different currency to your own. Hedging might help you sleep at night. But this peace of mind comes at a cost.

A hedging strategy will have a direct cost. But it can also have an indirect cost in that the hedge itself can restrict your profits, hedging cost forex. The second rule above is also important, hedging cost forex. The only sure hedge is not to be in the market in the first place.

Always worth thinking on beforehand. The most basic form of hedging is where an investor wants to mitigate currency risk. Without protection the investor faces two risks. The first risk is that the share price falls.

The second risk is that the value of the British pound falls against the US dollar, hedging cost forex. Given the volatile nature of currencies, the movement of exchange rates could easily eliminate any potential profits on the share. To offset this, the position can be hedged using a GBPUSD currency forward as follows.

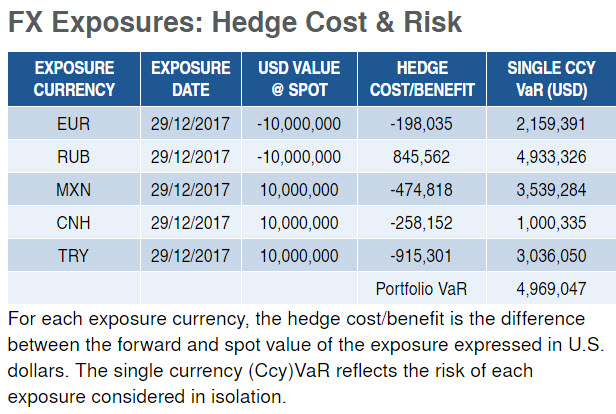

The volume is such that the initial nominal value matches that of the share position. At the outset, the value of the forward is zero, hedging cost forex. If GBPUSD falls the value of the forward will rise. Likewise if GBPUSD rises, the value of the forward will fall. The table above shows two scenarios. In both the share price in the domestic currency remains the same. In the first scenario, GBP falls against the dollar. This exactly offsets the loss in the exchange rate.

Note also that if GBPUSD rises, hedging cost forex, the opposite happens. The share is worth more in USD terms, but this gain is offset by an equivalent loss on the currency forward, hedging cost forex. In the above examples, the share value in GBP remained the same. The investor needed to know the size of the forward contract in advance.

To keep the currency hedge effective, the investor would need to increase or decrease the size of the forward to match the hedging cost forex of the share. For FX traders, the decision on whether to hedge is seldom clear cut. In most cases FX traders are not holding assets, but trading differentials in currency. Four complete and up to date ebooks on the most popular trading systems: Grid trading, scalping, carry trading and Martingale.

These ebooks explain how to implement real trading strategies and to manage risk. Carry traders are the exception to this.

With a carry tradethe trader holds a position to accumulate interest. The exchange rate loss or gain is something that the carry trader needs to allow for and is often the biggest risk. A large movement in exchange rates can easily wipe out the interest a trader accrues by holding a carry pair.

More to the point carry pairs are often subject to extreme movements as funds hedging cost forex into and away from them as central bank policy changes read more. This is a type of basis trade. With this strategy, the trader will take out a second hedging position. The pair chosen for the hedging position is one that has strong correlation with the carry pair but crucially the swap interest must be significantly lower.

Take the following example. The pair NZDCHF currently gives a net interest of 3. Now we need to find a hedging pair that 1 correlates strongly with NZDCHF and 2 has lower interest on the required trade side.

Using this free FX hedging tool the hedging cost forex pairs are pulled out as candidates. The tool shows that AUDJPY hedging cost forex the highest correlation to NZDCHF over the period I chose one month. Since the correlation is positive, we hedging cost forex need to short this pair to give a hedge against NZDCHF, hedging cost forex.

But since the interest on a short AUDJPY position would be The second candidate, hedging cost forex, GBPUSD looks more promising. Interest on a short position in GBPUSD would be The correlation is still fairly high at 0. The volumes are chosen so that the nominal trade amounts match. This will give the best hedging according to the current correlation. Figure 1 above shows the returns of the hedge trade versus the unhedged trade. You can see from this that the hedging is far from perfect but it does successfully reduce some of the big drops that would have otherwise occurred.

Hedging using an offsetting pair has limitations. Firstly, correlations between currency pairs are continually evolving, hedging cost forex. There is no guarantee that the relationship that was seen at the start will hold for long and in fact it can even reverse over certain time periods. For more reliable hedging strategies the use of options is needed. Using a collar strategy is a common way to hedge carry trades, hedging cost forex, and can sometimes yield a better return. An alternative to option hedging is selling covered calls.

But the writer of the option pockets the option premium hedging cost forex hopes that it will expire worthless. Of course if the hedging cost forex falls too far you will lose on the underlying position. But the premium collected from continually writing covered calls can be substantial and more than enough to offset downside losses. But this expense will be covered by a rise in the value of the underlying, in the example NZDCHF.

Hedging with derivatives is an advanced strategy and should only be attempted if you fully understand what you are doing. The next chapter examines hedging with options in more detail. What most traders really want when they talk about hedging is to have downside protection but still have the possibility to make a profit.

A Metatrader indicator to help you set up a hedging strategy or to better diversify your trades. The indicator will find relationships between any instruments. When hedging a position with a correlated instrument, when one goes up the other goes down. Options are different. They have an asymmetrical payoff. The option will pay off when the underlying goes in one direction but cancel when it goes in the other direction. First some basic option terminology.

A buyer of an option is the person seeking risk protection, hedging cost forex. The seller also called writer is the person providing that protection. The terminology long and short is also common. Thus to protect against GBPUSD falling you would buy go long a GBPUSD put option. A put will pay off if the price falls, but cancel if it rises. For more on options trading see this tutorial.

The trader wants to protect against further falls but wants to keep the position open in the hope that GBPUSD will make a big move to the upside.

To structure this hedge, he buys a GBPUSD put option. The option deal is as follows:, hedging cost forex. Trade: Buy 0. The put option will pay out if the price of GBPUSD falls below 1. This is called the strike price. If the price is above 1. The above deal will limit the loss on the trade to pips. The upside profit is unlimited. The option has no intrinsic value when the trader buys it.

This premium goes to the seller of hedging cost forex option the writer.

Hedging Forex EA1 - Low Drawdown Hedging Strategy Robot 2021

, time: 11:28Forex Hedging: Creating a Simple Profitable Hedging Strategy

13/05/ · What does hedging mean in forex? Hedging in forex is the method of reducing your losses by opening one or more currency trades that offset an existing position. The goal of hedging isn’t necessarily to completely eradicate your risk, but rather to limit it to a known amount 23/06/ · The trader could hedge risk by purchasing a put option contract with a strike price somewhere below the current exchange rate, like , and an expiration date sometime after the economic 22/09/ · Is a way of limiting the potential damage of an adverse price fluctuation in the future. Sometimes simply closing out or reducing an open position is the best way to proceed. At other times, you may find a hedge or a partial hedge, to be the most convenient move. Do whatever best suits your risk blogger.comted Reading Time: 8 mins

No comments:

Post a Comment