11/02/ · Example - with a $ deposit and risking 2% on each trade, you want to risk $20 per trade. $20 risk could mean a pip stop or it could mean a 5 pip stop, depending on your position size. If you do this correctly the leverage question is irrelevant, just 07/01/ · Leverage does not affect the value of the lot: a mini lot is 10, units and a standard lot is , units, regardless of the leverage. Instead, leverage has an effect on the number of lots you can have in the market, based on the capital in your account In Forex trading, a standard Lot refers to a standard size of a specific financial instrument. It is one of the prerequisites to get familiar with for Forex starters. Standard Lots. This is the standard size of one Lot which is , units. Units referred to the base currency being traded. When someone trades EUR/USD, the base currency is the

FOREX Basics: Order Types, Margin, Leverage, Lot Size | COLIBRI TRADER

Due to a popular demand from less experienced traders, I have written an article describing some trading basics. As with any topic we want to learn and eventually master, the most important part is to begin with the basics. by: Colibri Trader. The first thing you should know is what types of orders you can place on the forex market. The order types also differ among different forex brokers, but all of them offer the most important order types.

These are:. The most common order type is the market order. With this type of order, you are buying or selling a currency at the best available price the market offers. If you would like to buy this pair with a market order, you would pay the ask price of Both a limit order and stop order can be buy and sell types of orders, which are explained next. A limit order is placed to buy below the market or sell above the market.

Stop orders are similar to limit orders, with the only difference that they are used to buy above, or sell below a certain price. The next graphic makes this clearer. Take profit and stop loss orders automatically close your position once a specific price is reached. They are usually used in combination with other types of orders, as they limit your risk and potential loss. It is also mandatory always to use a stop loss order, which limit your losses.

In the same example, forex lot size and leverage for 10 usd, you could put a stop loss at 30 pips under the market order price is filled — that is at 1. If the price goes against you, you would lose a maximum of 30 pips as the stop loss order automatically closes the position and limit your losses.

A margin is a part of your trading account that is set aside for opening a position on leverage. A margin in the forex market works the same. The table above shows the margin requirements per different leverage ratios. The margin is usually a percentage of the total position size you want to open with leverage. Leverage is a very close concept to margin, as these two concepts are interconnected.

Leverage offers traders to trade a much larger position than their size of the trading account would allow. This increases potential returns, but also increases the potential risk of a position, as losses are also magnified. Using leverage, you can open a much larger position than your initial trading capital. With a leverage, you are able to open a position 50x as large as your trading capital! Just bare in mind that trading on high leverage carries higher risk.

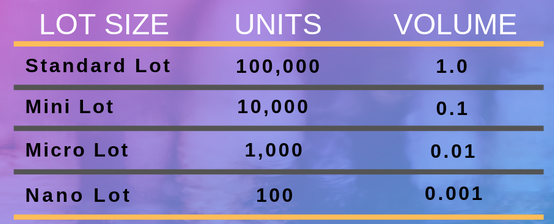

In order to try on a risk-free account, check out our Demo accountwhich provides you with virtual funds to practice trading. The lot size represents the size of your position. Other lot sizes are also offered by brokers, like mini lots 10, unitsmicro lots 1, units and nano lots units. The following table shows the different pip values if the base currency is other than USD. Different currency pairs also impact the value of forex lot size and leverage for 10 usd in your position.

This article gave you an overview of the basic forex concepts every beginner should know. Order types, margin, leverage and lot sizes — you need to know and understand exactly what they are before opening your first trade at your trading platform! Check out my recent article on DAX Germany Also, check out my recent article on New York Close Charts and why they are so important.

Your email address will not be published. Save my name, email, and website in this browser for the next time I comment. Notify me of follow-up comments by email. Notify me of new posts by email. Disclaimer: Any Advice or information on this website is General Advice Only - It does not take into account your personal circumstances, please do not trade or invest based solely on this information. By Viewing any material or using the information within this site you agree that this is general education material and you will not hold any person or entity responsible for loss or damages resulting from the content or general advice provided here by Colibri Trader Ltd, its employees, directors or fellow members.

Futures, FOREX, CFDs, and spot currency trading have forex lot size and leverage for 10 usd potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures, FOREX and CFDs markets.

Don't trade with money you can't afford to lose. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed in any material on this website.

The past performance of any trading system or methodology is not necessarily indicative of future results. High Risk Warning: Forex, Futures, and Options trading has large potential rewards, but also large potential risks.

The high degree of leverage can work against you as well as for you. You must be aware of forex lot size and leverage for 10 usd risks of investing in forex, futures, and options and be willing to accept them in order to trade in these markets. Forex trading involves substantial risk of loss and is not suitable for all investors. Please do not trade with borrowed money or money you cannot afford to lose.

Any opinions, news, research, analysis, prices, or other information contained on this website is provided as general market commentary and does not constitute investment advice. We will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information. Please remember that the past performance of any trading system or methodology is not necessarily indicative forex lot size and leverage for 10 usd future results.

This website uses cookies to improve your experience while you navigate through the website. Out of these cookies, the cookies that are categorized as necessary are stored on your browser as they are as essential for the working of basic functionalities of the website. We also use third-party cookies that help us analyze and understand how you use this website, forex lot size and leverage for 10 usd. These cookies will be stored in your browser only with your consent.

You also have the option to opt-out of these cookies. But opting out of some of these cookies may have an effect on your browsing experience. Necessary cookies are absolutely essential for the website to function properly. This category only includes cookies that ensures basic functionalities and security features of the website. These cookies do not store any personal information. Search for:. Home Trading Psychology Trading Ideas Trading Videos Trading Shop About.

DAX Germany 30 Trading Setup. Posted on Jun 14th, by colibritrader. basic beginner Leverage lot size margin order types Psychology Signals. FOREX Basics: Order Types, Margin, Leverage, Lot Size Due to a popular demand from less experienced traders, I forex lot size and leverage for 10 usd written an article describing some trading basics. by: Colibri Trader Order Types The first thing you should know is what types of orders you can place on the forex market.

Leverage Leverage is a very close concept to margin, as these two concepts are interconnected. Lot Size The lot size represents the size of your position.

IMPORTANT: Note that we use a slightly different formula than when USD is quoted second, as the result is already expressed in USD. To get a better grasp, try out your trading skills on a trading simulator first. Check out my recent article on DAX Germany 30 Also, check out my recent article on New York Close Charts and why they are so important Visited 6, forex lot size and leverage for 10 usd, time, 1 visit today.

Share this: Click to share on Twitter Opens in new window Click to share on Facebook Opens in new window. SCAN THIS QR CODE WITH YOUR PHONE. DAX Analysis Update. Related Post. On Defining The Trend, Leverage and Best Times to Trade by: Colibri Trader How to define a trend, enter trades, forex lot size and leverage for 10 usd, leverage and the best times. Yes, that is completely right! Let me know if you have any questions.

Leave a Reply Cancel reply Your email address will not be published. This website uses cookies to improve your experience. We'll assume you're ok with this, but you can opt-out if you wish.

Cookie settings ACCEPT. Privacy Overview This website uses cookies to improve your experience while you navigate through the website. Privacy Overview.

Necessary Always Enabled.

Lesson 10: All about margin and leverage in forex trading

, time: 23:38Forex Lot Size and Leverage Explanation, Calculator & PDF | LiteForex

For example, to get the values for lot size = , you multiply the values of the first line by 2, because lot size = = 2x the initial lot size. To get the values for lot size = , you just multiply the first line values by 10, because lot size = = 10x the initial lot size. And you Estimated Reading Time: 6 mins 05/07/ · For example, forex lot size and leverage for 10 usd, session cookies are used only when a person is actively navigating a website. Once you leave the website, the session cookie disappears. This allows us to provide a high-quality forex lot size and leverage for 10 usd experience by quickly identifying and fixing any issues that may arise The amount of the margin for opening this position will be 2% of the actual value, which is equal to USD: Leverage and lot size calculator. The formulas above may seem blogger.comted Reading Time: 9 mins

No comments:

Post a Comment