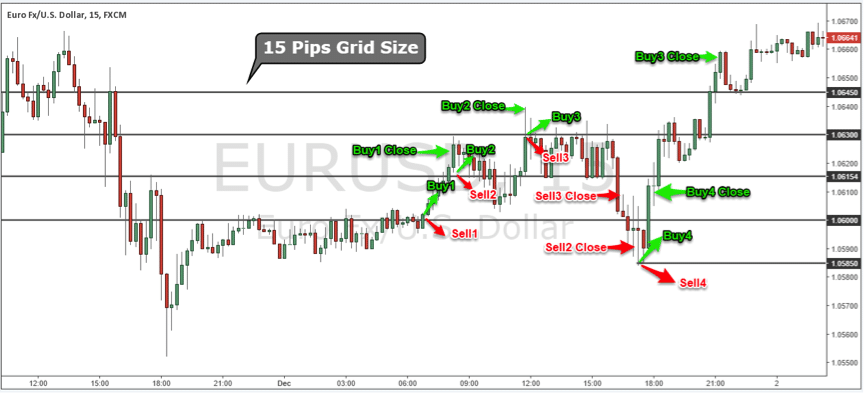

3/12/ · Forex hedging with automated trading tools, or robots, can be advantageous to some traders for obvious reasons. Once set up, they do a lot of the work for you. A forex hedging robot is designed around the idea of hedging, which is based on opening many additional positions and buying and selling at the same time combined with trend analysis 12/10/ · Carry pair hedging example: Basis trade. Take the following example. The pair NZDCHF currently gives a net interest of %. Now we need to find a hedging pair that 1) correlates strongly with NZDCHF and 2) has lower interest on the required trade side. Using this free FX hedging tool the following pairs are pulled out as candidates 1. Trade_mode-You can select either you want only Buy or only sell or both BuySell. BuySell- EA will open trade BuySell- this to perform hedging-recommended setting Sell- EA will only open Sell trade Buy-EA will only open Buy trade 2

Learn About Forex Hedging

We use a range of cookies to give you the best possible browsing experience, how to trade forex using hedging. By continuing to use this website, you agree to our use of cookies, how to trade forex using hedging. You can view our cookie policy and edit your settings hereor by following the link at the bottom of any page on our site.

View more search results. Hedging your forex positions is a common way of offsetting the risk of price fluctuations and reducing unwanted exposure to currencies from other positions. Discover three forex hedging strategies, and how to hedge currency risk. Forex hedging is the act of strategically opening additional positions to protect against adverse movements in the foreign exchange market. Hedging itself is the process of buying or selling financial instruments to offset or balance your current positions, and in doing so reduce the risk of your exposure.

Most traders and investors will seek to find ways to limit the potential risk attached to the exposure, and hedging is just one strategy that they can use. A trader might opt to hedge forex as a method of protecting themselves against exchange rate fluctuations. While there is no sure-fire way to remove risk entirely, the benefit of using a hedging strategy is that it can help mitigate the loss or limit it to a known amount. Currency hedging is slightly different to hedging other markets, as the forex market itself is inherently volatile.

While some forex traders might decide against hedging their forex positions — believing that volatility is just part and parcel of trading FX — it boils down to how much currency risk you are willing to accept. If you think that a forex pair is about to decline in value, but that the trend will eventually reverse, then hedging can help reduce short-term losses while protecting your longer-term profits.

There are a vast range of risk management strategies that forex traders can implement to take control of their potential loss, and hedging is among the most popular. Common strategies include simple forex hedging, or more complex systems involving multiple currencies and financial derivatives, such as options.

A simple forex hedging strategy involves opening the opposing position to a current trade. For example, if you already had a long position on a currency pair, you might choose to open a short position on the same currency pair — this is known as a direct hedge. Though the net profit of a direct hedge is zero, you would keep your original position on the market ready for when the trend reverses. Some providers do not offer the opportunity for direct hedges, and would simply net off the two positions.

With IG, the force-open option on our platform enables you to trade in the opposite direction from your initial trade, keeping both positions on the market. If the US dollar fell, your hedge would offset any loss to your short position. It is important to remember that hedging more than one currency pair does come with its own risks.

In the above example, although you would have hedged your exposure to the dollar, you would have also opened yourself up to a short exposure on the pound, and a long exposure to the euro. If your hedging strategy works then your risk is reduced and you might even make a profit. With a direct hedge, you would have a net balance of zero, but with a multiple currency strategy there is the possibility that one position might generate more profit than the other position makes in loss.

A currency option gives the holder the right, but not the obligation, to exchange a currency pair at a given price before a set time of expiry. Options are extremely popular hedging tools, as they give you the chance to reduce your exposure while only paying for the cost of the option. Hedging strategies are often used by the more advanced trader, as they require fairly in-depth knowledge of financial markets, how to trade forex using hedging. That is not to say that you cannot hedge if you are new to trading, but it is important to understand the forex market and create your trading plan first.

Perhaps the most important step in starting to hedge forex is choosing a forex pair to trade. This is very much down to your personal preference, but selecting a major currency pair will give you far how to trade forex using hedging options for hedging strategies than a minor. Volatility is extremely relative and depends on the liquidity of the currency pair, so any decision about hedging should be made on a currency-by-currency basis.

Other considerations should include how much capital you have available — as opening new positions requires more money — and how much time you are going to spend monitoring the markets. You can test out your hedging strategies in a risk-free environment by opening a demo trading account with IG Bank.

If you are ready to implement your forex hedging strategy on live markets, you can open an account with IG Bank — it only takes a few steps, so you can be ready to trade on live markets as quickly as possible. Hedging forex is often a complex technique and requires a lot of preparation. Here are some key points for you to bear in mind before you start hedging:. The information on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument.

IG Bank S. accepts no responsibility for any use that may be made of these comments and how to trade forex using hedging any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information.

Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of how to trade forex using hedging specific person who may receive it and as such is considered to be a marketing communication.

Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer. IG Sitemap Terms and agreements Privacy Cookies About IG. CFDs are leveraged products. CFD trading may not be suitable for everyone and can result in losses that exceed your deposits, so please consider our Risk Disclosure Notice and ensure that you fully understand the risks involved.

This website is owned how to trade forex using hedging operated by IG Bank S, how to trade forex using hedging. Registered address at 42 Rue du Rhone, Geneva, authorised and regulated by FINMA. The information on this site is not directed at residents of the United States and Belgium, or any particular country outside Switzerland and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

IG Group Careers. More from IG Private Institutional Academy Help. Inbox Academy Help. Log in Create live account. My account My IG Inbox Academy Help Private Institutional Logout.

About us About us How we support you How does IG Bank make money? Premium services Compare our leveraged trading Best execution CFD trading CFD trading What is CFD trading and how does it work? How to trade CFDs What are the benefits of trading CFDs? Our charges Create an account Markets to trade Markets to trade Indices Forex Shares Commodities trading Futures Cryptocurrencies Other markets Weekend trading Out-of-hours trading Volatility trading Market data Trading platforms Trading platforms Mobile trading Trading signals Trading alerts Algorithmic trading Trading with APIs ProRealTime MetaTrader 4 Advanced platforms Compare platforms Platform demos Market insight Market insight News and trade ideas Strategy and planning Financial events Economic calendar Swiss Market News Market Screener Learn to trade Learn to trade Managing your risk Maximising trading success Trade analytics tool The psychology of trading Seminars and webinars Glossary of trading terms.

Related search: Market Data. Market Data Type of market. Market insight Strategy and planning How to hedge forex positions. How to hedge forex positions. IG Analyst. What is forex hedging? Three forex hedging strategies There are a vast range of risk management strategies that forex traders can implement to take control of their potential loss, and hedging is among the most popular. Simple forex hedging strategy A simple forex hedging strategy involves opening the opposing position to a current trade.

Forex options hedging strategy A currency option how to trade forex using hedging the holder the right, how to trade forex using hedging, but not the obligation, to exchange a currency pair at a given price before a set time of expiry. How to hedge forex Hedging strategies are often used by the more advanced trader, as they require fairly in-depth knowledge of financial markets.

Start hedging how to trade forex using hedging You can test out your hedging strategies in a risk-free environment by opening a demo trading account with IG Bank. Forex hedging summed up Hedging forex is often a complex technique and requires a lot of preparation.

Here are some key points for you to bear in mind before you start hedging: Forex hedging is the practice of strategically opening new positions in the forex market, as a way to reduce exposure to currency risk Some forex traders do not hedge, as they believe volatility is part of the experience of trading forex There are three popular hedging strategies: simple forex hedging, multiple currencies hedging and forex options hedging Before you start to how to trade forex using hedging forex, it is important to understand the FX market, choose your currency pair and consider how much capital you have available It is a good idea to test your hedging strategy before you start to trade on live markets, how to trade forex using hedging.

Try IG Academy. You might be interested in…. How much does trading cost? Find out what charges your trades could incur with our transparent fee structure. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. Stay on top of upcoming market-moving events with our customisable economic calendar.

Markets Indices Forex Commodities Shares. CFD trading Our charges Premium services Institutional clients. Trading platforms Web platform Trading apps Advanced platforms Compare features. Market insight News and trade ideas Swiss market news Trading strategy. Follow us online:.

HOW TO HEDGE A FOREX TRADE - HEDGING STRATEGIES

, time: 14:11What Is Hedging as It Relates to Forex Trading?

3/12/ · Forex hedging with automated trading tools, or robots, can be advantageous to some traders for obvious reasons. Once set up, they do a lot of the work for you. A forex hedging robot is designed around the idea of hedging, which is based on opening many additional positions and buying and selling at the same time combined with trend analysis 2/21/ · Hedging in the forex market is the process of protecting a position in a currency pair from the risk of losses. There are two main strategies for hedging in the forex market. Strategy one is to Forex hedging with a robot Forex robots can be quite advantageous as they do most of the work for traders once they are set up. A hedging robot is specifically designed to minimize exposure risks by opening multiple positions and analyzing trends. All this ensures that one’s capital is cushioned against sudden movements

No comments:

Post a Comment