A binary option is in essence a variant of a traditional financial option. It has the same characteristics, namely a strike, expiry time and price. The difference between a binary option and a CFD is that a binary option has a binary payoff. The trader can either get 1 (or ) or 0 Similarities Between CFDs and Binary Options. CFDs and binary options are similar in the following ways: They are derivatives - You do not have to own the underlying asset to trade on the asset. They have short trading periods - For both binary options and CFDs, traders can select trading periods as short as one hour to a week depending on your trading goals Binary options provide more certainty of potential gains and losses than CFDs. CFDs are risky as the amount that an asset could rise or fall is significant and could result in big losses. Binary options require fewer fees and commissions than CFDs, in part because commission for binary options is calculated from the source

CFD vs Binary Options – choose the right trading option

Contracts for difference CFD and binary options are some of the most popular trading instruments available to online traders. This article will show you the difference and similarities between CFDs and binary options, so you can determine the most appropriate instruments for your trading needs. A CFD is also known as a contract for difference, binary options vs cfd. This is a contract between the trader and the broker to exchange the difference between the entry price and the exit price of an underlying asset.

In this case, the broker is the seller and the trader is the buyer, binary options vs cfd. The broker therefore sells to the trader the difference made between the opening price and the closing price of an underlying asset. The trader you will pay the broker if the difference between the opening and closing price of the underlying market is negative. Just like binary optionstraders use CFDs to predict the future price movement of underlying assets, without the need to own the underlying assets.

You can go short i, binary options vs cfd. sell your contract so you can earn profits from falling prices. Alternatively, you can go long to profit from rising prices. You can also hedge your assets portfolio to balance off any potential losses in the value of the underlying asset. Although CFDs and binary options bear some similarities, these two trading instruments are also markedly different.

The major differences include:. In binary options trading, the trader is usually aware of binary options vs cfd potential loss or profit they will incur depending on the price movement of the underlying asset. However, with CFD trading, it is not possible to determine in advance, what you stand to gain or lose with the fluctuation of market prices.

This is because CFD trading entails trading on the difference between the entry and exit prices of the underlying asset. Advanced traders can earn more returns trading CFDs. However, the level of risk in Binary options vs cfd trading is considerably higher than trading binary options. Binary options vs cfd trading, unlike binary options trading involves paying commissions and fees for each trade you undertake. This is because CFDs are financed with borrowed money so traders are able to trade numerous underlying assets at a small price.

Each broker has their own fee and commissions structure. When it comes to binary options trading, traders are not required to pay additional fees or commissions other than the initial investment. No fees are payable even if the trade ends out of money i. even if you lose. Instead of rebates, binary options vs cfd, CFD traders are allowed to hedge against losses by applying their own stop losses. But stop losses can only be applied when losses are already imminent.

Trading CFD offers you access to a much wider pool of bases including bonds, forex, indices etc. On the contrary, binary options trading requires the existence of an underlying asset—this mean forex and index cannot be traded using binary options.

If you are looking to access more bases for trading, CFDs offer a better option. They are derivatives - You do not have to own the underlying asset to trade on the asset.

They have short trading periods - For both binary options and CFDs, traders can select trading periods as short as one hour to a week depending on your trading goals.

Price movement prediction - Both trading instruments entail making predictions about market prices of underlying assets, binary options vs cfd. While both CFD and binary options trading bear considerable risk, CFDs are invariably riskier with potentially binary options vs cfd returns.

CFDs are also more appropriate trading instruments for advanced or professional binary options traders. General Risk Warning : The financial services provided by this website carry a high level of risk and can result in the loss of all your funds.

You should never invest money that you cannot afford to lose. Your capital may be at risk. This material is not investment advice. You should consider whether you can afford to take the high risk of losing your money.

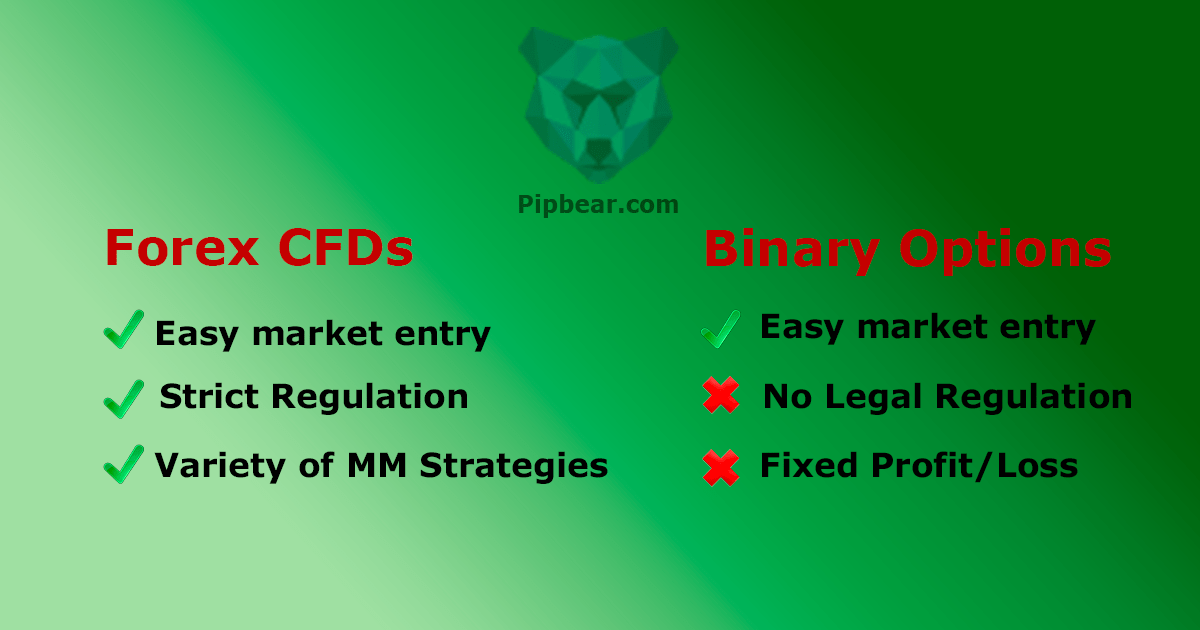

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. About Us Disclaimer. User Name. Login Register. What Is the Difference between CFD and Binary Options? Differences between CFDs and Binary Options Although CFDs and binary options bear some similarities, these two trading instruments are also markedly different. The major differences include: Level of risk In binary options trading, the trader is usually aware of the potential loss or profit they will incur depending on the price movement of the underlying asset.

Investment amount CFD trading, unlike binary options trading involves paying commissions and fees for each trade you undertake. Range of tradable underlying assets Trading CFD offers you access to a much wider pool of bases including bonds, forex, indices etc. Similarities Between CFDs and Binary Options CFDs and binary options are similar in the following ways: They are derivatives - You do not have to own the underlying asset to trade on the asset.

Conclusion While both CFD and binary options trading bear considerable risk, CFDs are invariably riskier with potentially high returns. Related Items:. Joomla SEF URLs by Artio. User Name Password Remember Me.

What Is a CFD Contract? - Example Trading at IQ Option

, time: 9:07Binary Options vs CFD – A Straightforward Comparison

Binary options provide more certainty of potential gains and losses than CFDs. CFDs are risky as the amount that an asset could rise or fall is significant and could result in big losses. Binary options require fewer fees and commissions than CFDs, in part because commission for binary options is calculated from the source 4. · Another popular derivative that is often contrasted with CFDs are options (options, not binary options). Designed to be traded on exchanges rather than with brokers, options differ in terms of the outcome they deliver to traders, and therefore the situations in which one or other instrument is more appropriate will vary depending on what you’re trying to achieve Binary Options vs CFD: Controlling Profit. In Binary Options your profit and loss are not affected by the distance that price travelled from your entry. One pip is all you need to win or lose a trade but the payout will be the same even if price travelled 50, or 1, pips because in Binary Options you are either right or wrong, it doesn’t matter by how much

No comments:

Post a Comment