/04/17 · 1. Forex Trading Strategies that Work #1 – Day Trading. 2. Forex Trading Strategies that Work #2 – Swing Trading. 3. Forex Trading Strategies that Work #3 – Position Trading. 4. Which Forex Trading Strategies is Right for You? 5. Conclusion: Choosing the Right Forex Strategy for You Ready? Let’s begin and go through the first forex trading strategy that works The 3 EMAS forex trading strategy is a very simple trend trading forex strategy that is based on 3 exponential moving averages(EMA).. Now, because this forex trading strategy involves 3 EMAS, it may be quite hard to understand at first (if you are beginner forex trader) therefore I suggest your read not only once but times to fully understand and then also refer to the chart below /10/28 · The Forex trading strategies you can use are scalping, day trading, or short-term swing trading

TOP 3 most profitable forex strategies – Forex strategies – blogger.com

Finder is committed to editorial independence. While we receive compensation when you click links to partners, they do not influence our content.

While we receive compensation when you click links to partners, they do not influence our opinions or reviews. Learn how we make money. Markets trade differently and move in various cycles. So before you devise a trading strategy, become familiar with how each asset class behaves.

Equity markets tend to trend for longer periods, since many stock investors are looking for long-term returns and retirement income. Currencies tend to be more volatile and dynamic, and they tend to revert to the mean — or move back to a more normal average — more quickly. The foreign exchange market, 3 forex trading strategies, often abbreviated to FXis a great market to trade, but it tends to be more sensitive than equities. Commodities run in a more cyclical pattern due to harvesting and mining cycles.

For example, grains tend to follow weather and demand patterns. Coffee is used all year-round, but futures from different markets follow harvesting cycles in their respective regions.

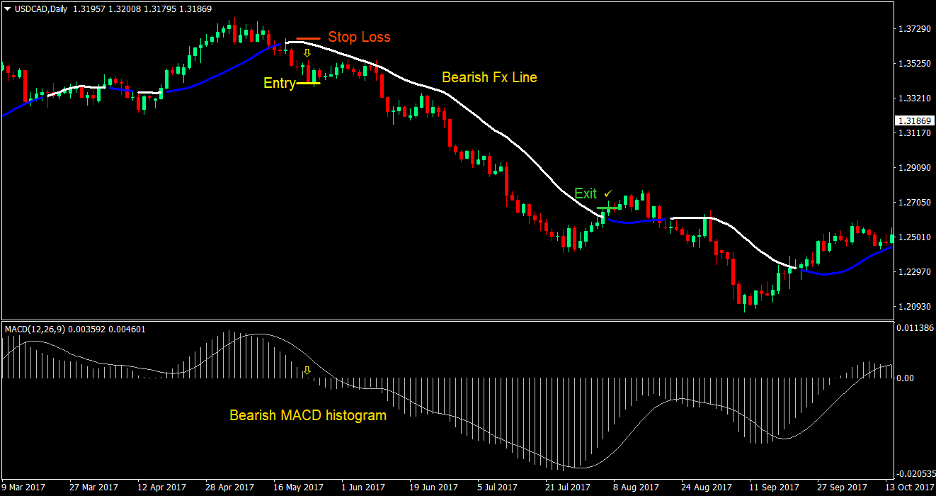

A technical-based moving average can help traders spot long-term price trends by considering the average trend over a period of time, rather than focusing on day-to-day price movements. This strategy can help you control risk more easily than some other strategies, and it has a clear entry point.

You can 3 forex trading strategies the time frames yourself, but note that trading 3 forex trading strategies shorter time frames involves more risk, as prices can be more volatile and your stop-loss can cancel you out of your position quickly.

Start with a four-hour chart and add a period 3 forex trading strategies average — or an average of the last 30 four-hour periods. Now, each time the price crosses the moving average in either direction, you take a position.

This chart highlights the basic premise of the strategy: the long position or buy on the left side of the chart, the stop-loss or risk limit at the bottom left of the chart and then, finally, at the top right, the exit of the trade, where the price crosses back below the moving average.

Wave trading is when you trade pullbacks in a trending market. First, you need to establish a trend. You can do this by looking at the closing prices each day over a period of time. To some investors, it can be difficult to buy a security at the highs, 3 forex trading strategies. But to seasoned investors, this is a common strategy to follow momentum and hold positions for a significant period of time.

In this chart, the highlighted area at the top must break for a position to be added. You can see the index has been trading in an uptrend, 3 forex trading strategies. Following this trend could benefit you.

You can determine risk by the size of your position and where the previous waves begin. In our 3 forex trading strategies, a stop has been suggested around halfway into 3 forex trading strategies trend. This might be sufficient to achieve a decent risk to reward. However, if you have a higher tolerance to risk, you could place the stop lower down at the point, before the waves begin in the uptrend. To help limit your risk with this trading strategy, you can start with a smaller position, and when each wave high is broken, add more to the position as desired.

Once a trendline is broken, it can become a reference 3 forex trading strategies for future prices. Determining the trendline and drawing it correctly is the hard part. Similar to wave trading, a trendline can be drawn by looking at the previous closing prices over a set period of time.

If each closing price is lower than the previous price, it could signal a downtrend. All price action must be under the 3 forex trading strategies — that is, none of the price action must be above the line 3 forex trading strategies drawing a down trendline, and vice versa for an uptrend. As you can see, 3 forex trading strategies, there is a steep down trendline plotted in the middle of the chart.

The buy signal is triggered on the break of the trendline. Because the trend has been broken, the trader assumed the price would now continue in an upward direction instead, which you can see it did for a short time.

However, the price quickly went down again, which is when the stop was executed and the position closed at a loss. As a trader, you must be prepared to take losses, as not all trades go according to plan. 3 forex trading strategies risk management is key to all forex trading strategies. A clear trading plan and strategy in trading is among the most important — and toughest — aspects for traders to establish.

But it could mean the difference between success and failure. Software like TradingView can do this for you, but you can also do it manually. Demo trading is also another way to see if you have a handle on executing the plan and controlling the money management.

Obviously, you cannot win every trade. But if you control the risk to reward and manage your account, you can be at least halfway in the right direction, 3 forex trading strategies. Something else to consider: your personal emotions. If you enjoy the adrenaline and can stick to your trading plan, then a short-term system may be what you like.

Rajan Dhall has been trading and investing professionally for more than 10 years. He is a full member of the Society of Technical Analysts and is also a Chartered Financial Technician with the International Federation of Technical Analysts. Rajan has vast experience in developing and testing complex trading systems, focusing on the equity, futures and foreign exchange markets.

He also provides market commentary services to many dedicated investors, traders as well as financial institutions and hedge funds. Rajan believes psychology is the key to trading success and focuses on this aspect in all areas of trading. CM Trading lets you trade CFDs, Forex, 3 forex trading strategies, crypto, and more. Explore the features you can get with a CM Trading account in South Africa.

We asked 47 experts for their cryptocurrency price predictions and took a deep dive into the Bitcoin price rally. This vacation-rental giant has finally gone public. Learn how to invest in Airbnb in South Africa. Click here to cancel reply. Optional, only if you want us to follow up with you. Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve, 3 forex trading strategies.

au is one of Australia's leading comparison websites. We compare from a wide set of banks, insurers and product issuers. We value our editorial independence and follow editorial guidelines. finder has access to track details from the product issuers listed on our sites. Although we provide information on the products offered by a wide range of issuers, we don't cover every available product or service. Please note that the information published on our site should not be construed as personal advice and does not consider your personal needs and circumstances.

While our site will provide you with factual information and 3 forex trading strategies advice to help you make better decisions, it isn't a substitute for professional advice.

You should consider whether the products or services featured on our site are appropriate for your needs. If you're unsure about anything, seek professional advice before you apply for any product or commit to any plan. Products marked as 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature.

Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category.

We encourage you to use the tools and information we provide to compare your options. Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity.

We provide tools so you can sort and filter these lists to 3 forex trading strategies features that matter to you. We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, 3 forex trading strategies, associated companies or different labelling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues. Providing or obtaining an estimated insurance quote through us does not guarantee you can get the insurance.

Acceptance by insurance companies is based on things like occupation, health and lifestyle. By providing you with the ability to apply for a credit card or loan, we are not guaranteeing that your application will be approved. Your application for credit products is subject to the Provider's terms and conditions as well as their application and lending criteria.

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy. Online Trading. Rajan Dhall. Posted May 22, 3 forex trading strategies Learn more about how we fact check. Navigate Share Trading Guides Online trading Forex trading Invest in gold. Buy Shares In AMD Alibaba Amazon Apple Barloworld 3 forex trading strategies Facebook MultiChoice Netflix Nvidia Sanlam Sasol Shoprite Stefanutti Tesla A-Z shares list.

What's in this guide? Understand how different markets move Trading strategy 1: Technical-based moving average Trading strategy 2: Wave trading Trading strategy 3: Trendlines Risk management strategies Bottom line. Disclaimer: The value of any investment can go up or down depending on news, trends and market conditions. We are not investment advisers, so do your own due diligence to understand the risks before you invest.

Forex Trading the 3 Bar Reversal Pattern

, time: 28:203 EMA Forex Trading Strategy

Scalping strategy "Bali" This trading strategy allows trading on the H1 timeframe with a EUR / USD currency pair.. As assistants, you will need the Linear Weighted Moving Average (period - 48), Trend Envelopes_v2 (period - 2) and DSS of momentum (parameters: , 3, 8) indicators The pin bar trading strategy is best traded as a reversal pattern in the direction of the major trend; The inside bar trading strategy is best traded as a continuation pattern; The Forex breakout strategy should be traded after a break and retest of either support or resistance The 3 EMAS forex trading strategy is a very simple trend trading forex strategy that is based on 3 exponential moving averages(EMA).. Now, because this forex trading strategy involves 3 EMAS, it may be quite hard to understand at first (if you are beginner forex trader) therefore I suggest your read not only once but times to fully understand and then also refer to the chart below

No comments:

Post a Comment